Vehicle Data – Why You Shouldn't Be Afraid to Share It

Data. It’s changing the world, from smartphones to airlines to connected appliances, every industry needs information to survive. Customers demand personalized experiences and businesses demand analytics to make the right decisions, from “anytime, anywhere” home delivery services to industrial manufacturing. Without a doubt though, very few applications can match the advantages you gain when you use your own data from a connected vehicle to help you save money on your car insurance.

With your consent, your modern car, truck, or SUV collects input from your vehicle every time you drive. Hundreds of sensors in the vehicle are able to monitor elements such as wheel speed, G-forces, the activity of safety systems, and even when your vehicle needs its next maintenance.

Why is your vehicle collecting all of this? Some details help keep your vehicle running at its best and others offer more advanced features customers have come to expect such as automatic steering, acceleration, braking and the location of obstacles. Modern vehicles are equipped with a device called a Data Communication Module (DCM) designed to transmit telematics data every single second. Anti-lock braking systems (ABS), traction control, adaptive cruise control, all need to collect feedback from dozens of vehicle systems so that you can use them when you drive.

Photo By ZinetroN/Shutterstock

Make Your Data Work for You

We’ll get back to what’s done with the input, and how your information is kept secure, but first, how can you use your data to save money? With insurance that uses your vehicle data to monitor your driving and make a more accurate risk assessment.

Car insurance companies traditionally rely on your driving record to help decide your rates. If you don’t have any crashes or claims, in the eyes of these companies, you are a lower risk. Lower risk means more affordable insurance. Typically, insured drivers receive calculated rates based on an average composite of demographics, age, gender, credit, and distance travelled. For example, two individuals living in the same neighborhood, driving the same car, with the same commute and the same occupation may receive the same risk assessment based on an average calculation. However, telematics from your vehicle can paint a clearer picture of your driving for your insurer. By opting in to share your data, it enables your rate to be influenced by how you, as a unique individual, drive. When your insurer can see tangible evidence that you’re a safe driver, you can see lower premiums.

Photo By Photoroyalty/Shutterstock

Usage Based Insurance

More than just a snapshot or big picture overview of your driving, UBI uses telematics data to monitor your driving behavior including how many miles you are driving. Some insurance companies use total miles driven as another factor in calculating risk, but they rely on your own estimates. If you find out that you’re covering less distance than you thought, you can potentially save more money on your car insurance.

This distance traveled statistic can come directly from your vehicle, but it can also be collected by a device that plugs into your vehicle’s onboard diagnostic port. Some insurance providers monitor your driving for just a few months, determining your driving habits, while others always leave the system on, charging you only for the actual distance driven.

It’s your data, make sure it’s as secure and accurate as possible

Insurance companies will often use an add-on device such as a phone app or Bluetooth® beacon to track facts like location, G-force, and speeds, but these do not always provide the most accurate measurements. If a passenger uses your phone and starts texting, now it looks to a data collection app like you’re distracted driving. Third party apps can’t tell what your vehicle safety systems are doing, but an on-board system is constantly analyzing information like lane departures or hard braking. As a reminder for parents with new drivers in the family, phone apps can be easily turned off and may not be able to transmit a vehicles condition and exact location in the event of an emergency. Not only that, but insurance companies can negatively score usage-based insurance premium based on inaccurate or incomplete data collection.

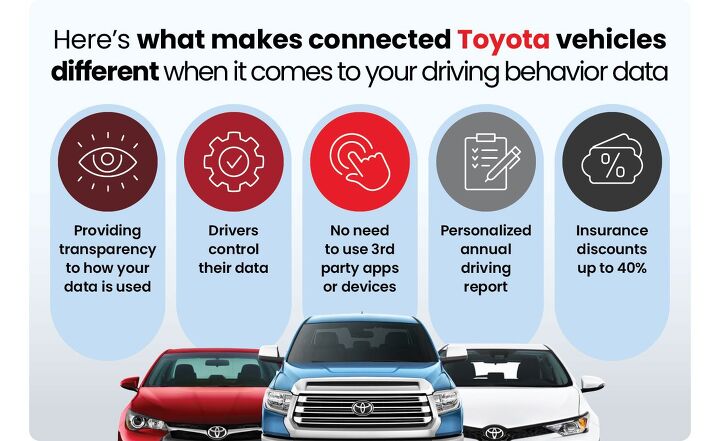

Why is Toyota Insurance Data Collection Different?

With around 300 sensors in the vehicle, your connected Toyota can monitor all your vehicle’s information. It can also transmit that data in real-time using an onboard modem. So you don’t have to worry about vehicle data slowing down your phone or costing you more by using up your phone’s data plan. Because it has access to more information, it paints the most accurate picture of what you’re doing in your vehicle, and how you’re driving.

Opting in to share driving information with Toyota Insurance Management Solutions via Insure Connect empowers you with your own data providing access to innovative products that have been created exclusively for drivers of Toyota vehicles using these systems, and rewarding participants for safe driving. Toyota recognizes the decision to share your data is an important one and all drivers should feel comfortable doing it. Part of that peace of mind is knowing that Toyota goes to great lengths to make sure your data is secure. Toyota follows robust global security best practices including use of the latest technology in firewalls, and a dedicated 24X7 information security team continually monitoring the Toyota cloud infrastructure in real-time. You can even get an annual report of your Toyota driving activity to see how safe you are driving.

The key part is that neither driving data, nor location information, nor personal information, is ever collected or shared without the consent of you, the customer. Your vehicle needs to read the data to operate, but it will only be collected and stored if you give the say-so. So, you can use your data to help you save money on your insurance, but you only share it if you want to.

Feature Photo By Brian A Jackson /Shutterstock

We are committed to finding, researching, and recommending the best products. We earn commissions from purchases you make using the retail links in our product reviews. Learn more about how this works.

Evan moved from engineering to automotive journalism 10 years ago (it turns out cars are more interesting than fibreglass pipes), but has been following the auto industry for his entire life. Evan is an award-winning automotive writer and photographer and is the current President of the Automobile Journalists Association of Canada. You'll find him behind his keyboard, behind the wheel, or complaining that tiny sports cars are too small for his XXXL frame.

More by Evan Williams

Comments

Join the conversation