Top 10 Reasons to Lease A Car

Leasing often gets a bad rap since you do not actually own a car at the end of the term.

But not everything about leasing a car is negative. If you’re looking for reasons to lease a car, here are some key reasons that showcase why you should.

You’ll Never Get Bored

New cars are coming out every year with more options, better fuel efficiency, more stylish looks and newer technology. You don’t want to miss out on all that, do you? Leasing is a great way to always have the keys to a newer car in your possession, and you’ll never fall out of love with your new ride. Plus it helps with keeping up with the Joneses. Those guys are fast!

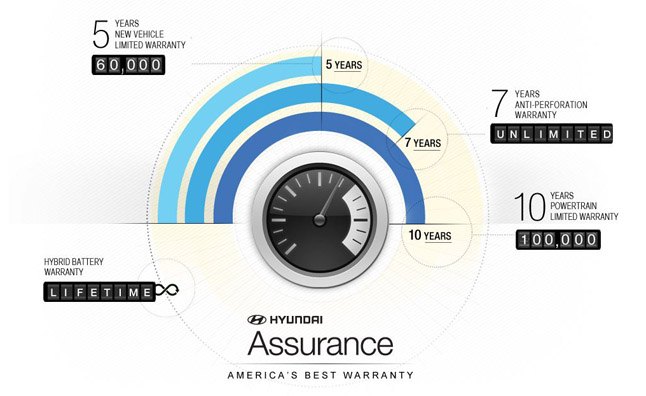

Warranty Coverage

Costs Less than Financing

No Long-Term Reliability Doubts

Worrying about long-term reliability is something that car buyers deal with. Leasing a car means you don’t have to worry about whether the car will age gracefully. Rust, interior wear and tear, and other long-term worries aren’t a problem in a leased car since they happen much later in the car’s life.

Perks for Business Usage

Taxes on a leased car occur on the monthly payments, not on the upfront cost. This means if you are using the car for business, you can deduct more. This is just one other way that leasing helps you save money over financing a car.

You Can Buy It After

In some cases, when your lease is done, you have the option of buying the car you just leased. Buying a similar car from new would cost much more, and the used car market is hit or miss. Compared to the crap shoot of other used cars out there, you already know the history of the car you’ve been leasing, and know how the car works for you. Leasing can act like a long-term test drive before you buy.

Lower Down Payment

Costs Less to get Nice Options

With the money you’re saving with cheaper monthly payments, tax deductions and lower down payments, you can spend a bit more on yourself, getting a nicer car in the process. Whether you get upgrades to your vehicle or a bigger or better car altogether is up to you, but thanks to the low cost of leasing, you can finally get the car you want.

Less Prone to Breaking Down

Even if most of the car is covered under warranty during the time you own it, it will be less prone to breaking down altogether. The first three years of a car’s life is its prime-time and bigger issues tend to show up after that time, meaning you don’t have to deal with it. Not only can you avoid those potential costs, you get to avoid the hassle of trips to the dealer. Some dealers even know that a car is less likely to have significant problems during a lease, and will “throw in” free maintenance programs as an incentive. In reality, you’re likely just saving the cost of an oil change, but it’s still nice to go to a dealer and get your car serviced without touching your wallet.

Don’t Worry About Depreciation

Sami has an unquenchable thirst for car knowledge and has been at AutoGuide for the past six years. He has a degree in journalism and media studies from the University of Guelph-Humber in Toronto and has won multiple journalism awards from the Automotive Journalist Association of Canada. Sami is also on the jury for the World Car Awards.

More by Sami Haj-Assaad

Comments

Join the conversation

The Leasify app for iPhone also highlights benefits of leasing and uses a proprietary algorithm to tell you if you are getting a good deal. Check it out - it's free.

This guy who wrote this load of crap is a tool or being paid to write this nonsense. You could say the same things almost verbatim for buying a new car and selling it when you're wanting another new one in 36 months. When you lease you make payments and have nothing to show for it. When you buy you have equity in the vehicle and if you bought right (at invoice or below) you can make $$$ when you sell. The ONLY reason to lease is if you can deduct the payment on your taxes as a business expense.