How to Buy Sports Car Insurance

Thinking about buying a new sports or performance car? The cost of insurance is probably one of your top concerns. However, performance car insurance may not necessarily make your premium skyrocket. In short, be careful how you shop, choose the right agency partner, and understand what insurance carriers consider potential risk.

Is it Expensive to Insure a Sports Car?

Maybe. In the romanticized muscle car era of the 1960’s and early 1970’s, it’s been alleged that, to keep insurance premiums low, manufacturers purposely underrated the advertised horsepower of some muscle cars. While there is some evidence this might have been true back then, insurance providers today do not just look at a horsepower figure, number of doors or even the brand name when it comes to calculating premiums.

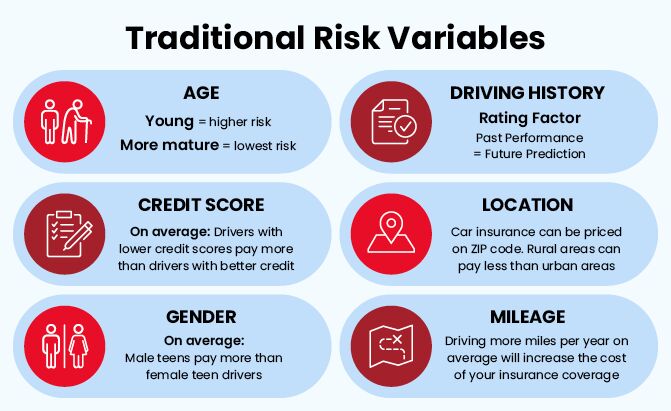

Your premiums are based on risk. That risk is calculated by statistical models, real-world insurance claims, and even telematics based on your driving behavior. So, if you happen to have a glovebox full of tickets and an inclination to ignore stop signs, you might see some steep premiums. But, if you have a clean record, that means you can find better offers from carriers.

Sports and performance cars are often a second car, this means they’re used differently. Motor enthusiasts with a show piece like the GR Supra, will likely drive fewer miles each year in that vehicle. Also, show vehicles are often saved for daytime drives in sunny weather.

Using the family sedan for daily commuting and winter driving might statistically increase the risk of a crash or incident that involves filing a claim. But driving that muscle car primarily in optimal conditions outside of peak travel times could reduce the probability of accidents and minimize claims. It’s not a guarantee, but factors like driving behavior and mileage all contribute to helping lower your premium.

It’s more expensive to insure a red car…. right? Actually, this is a myth, but it does have a bit of science behind it. Bright colors attract our attention, and your local police are no exception to that rule. For example, this means the eye will prioritize a brightly colored car, even if there are two vehicles travelling at the same speed. Your premium, however, is calculated on your past driving behavior and other factors. So, the good news is, your insurance carrier doesn’t care what color your car is unless you’ve invested in a custom paint job outside the factory color you purchased. That 3rd party cosmetic choice may require an optional add-on to your insurance policy.

How You Can Potentially Lower Your Premiums

Beyond driving safely and not getting tickets, data sharing can help you lower the insurance premium for your sports or performance car. Data sharing sends information about the way you drive and the amount you drive back to your insurance carrier. With models like the Toyota GR 86, your car can share your data with no third-party plug-ins. Good driving habits like gentle acceleration, no hard braking, no hard cornering, and traveling less often during peak drive times all come into play. Opting to share driving data using the Toyota app gives users access to Connected Toyota Car Insurance and can result in immediate discounts and savings for qualified drivers.

Usage Based Insurance can eliminate generalizations in these factors and give a more accurate reflection of your insurance risk, and could result in substantial savings

What About Modifications?

If you’re driving a sports car, you may be looking to make modifications. New wheels, power enhancements, cosmetic upgrades, and other custom parts. These add-ons are important when it comes to insurance because adding performance and appearance parts can potentially increase the amount your insurance has to pay when a claim is made. If you’ve spent $10,000 on custom wheels, you want to get an identical wheel as a replacement after a crash or if the wheels are stolen. If you don’t tell your insurer about them and add them to your policy, you could end up back on your factory wheels. Of course, you can choose to leave the wheels (or any other part you add to the car) off your policy. Your premium will be lower, but your extra equipment will not covered.

With highly modified and collector cars, a different form of insurance called Agreed Value Insurance could be the right choice. These policies are meant for vehicles that are difficult to put a value on because of customization, rarity, or even just being in excellent condition for their age. For example, let’s say you just spent three-times the going rate to buy an ultra-low-mile Toyota Celica Supra. Instead of “book value”, you and your insurance provider set a fair, agreed upon value for the car, and your rates are based around that value. Toyota Insurance can work with you to set up this type of insurance, though it may come with more restrictions than a conventional policy.

If you want more performance and customization than the standard car but don’t want a more specialized insurance product, consider upgrading with factory performance products first. Look for items like upgraded rims when purchasing a new car. Additions like performance braking packages, aerodynamic upgrades, and other accessories are available for your car at purchase. If they’re included with your vehicle at the time of purchase, they will be covered by your insurer. They’re also going to be a higher-quality part made to factory specs that underwent rigorous factory testing. Because the part is made to work perfectly with your car, factory upgrades can enhance your vehicle’s value without the need to add an extra insurance rider.

Insurance for your sports and performance vehicle is more complicated than insurance for a daily driver sedan or crossover because there are far more options available for you. Many of these options can help you save money, though, and can help you get an insurance product that works better to cover your specific needs. Whatever coverage you are looking for, a Toyota independent insurance agent can work with multiple national insurance partners and help guide you in deciding what you need so you can enjoy that sports car you have always wanted.

Feature Photo By NUTTANART KHAMLAKSANA/Shutterstock

*This article is sponsored by Toyota Insurance Management Solutions

Evan moved from engineering to automotive journalism 10 years ago (it turns out cars are more interesting than fibreglass pipes), but has been following the auto industry for his entire life. Evan is an award-winning automotive writer and photographer and is the current President of the Automobile Journalists Association of Canada. You'll find him behind his keyboard, behind the wheel, or complaining that tiny sports cars are too small for his XXXL frame.

More by Evan Williams

Comments

Join the conversation