How Car Insurance Premiums Are Calculated

Car insurance policies come in many different shapes and sizes, largely to give shoppers access to a car insurance product that’s perfect for them, their family, their vehicle, and their lifestyle.

Customers demand choice—and car insurance companies are using innovative solutions to offer more choice than ever before.

Of course, the car insurance policy you choose comes with various cost implications: including any deductibles you may need to pay in the event of a claim, as well as the insurance premiums themselves.

These premiums vary widely between customers, and are calculated once your insurance company assesses numerous factors. Below, we’ll look at some of the most common among these factors.

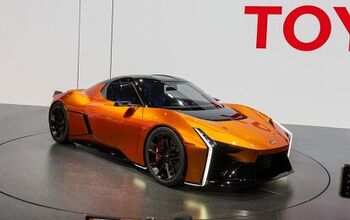

What You Drive

One of the biggest factors in determining your insurance premiums is the vehicle you drive.

Since your insurance may cover the costs of repair and reconditioning of the vehicle after an accident, insurers consider the predicted costs of repairing or replacing your vehicle if it’s involved in accident.

Your vehicle’s engine size, and the potential damage it could cause to another vehicle may be considered as well.

Some insurance policies also cover the medical costs associated with being injured in a motor vehicle accident. Accordingly, the vehicle’s safety rating, safety history, and other associated characteristics are considered as well.

Further, car insurance companies also consider the statistical likelihood of your vehicle being stolen, or involved in an accident. Higher-risk models come with higher-cost premiums, as they’re more likely to require an insurance claim.

How You Drive

Insurance is all about mitigating risk, and that’s why your insurance company also considers how often you drive, as part of calculating your car insurance premiums.

Lower-mileage drivers spend less time on the road, meaning reduced likelihood of an accident. This may translate into lower premiums. Higher-mileage drivers who spend more time on the road are more likely to be involved in an accident, and typically pay higher insurance premiums.

Some insurance companies can also electronically monitor driver behaviour by remote means, rewarding safer drivers with lower premiums. Talk to your insurance broker about how often you drive, and which insurance policies might be best for you.

Why You Drive

Is your vehicle used primarily for commuting and pleasure, or, for business purposes?

Your insurance premiums vary as a result of what you’re using your vehicle for. For instance, personal car insurance is designed for general use, but doesn’t cover accidents, damage, or theft that may take place while the vehicle is being used as a work vehicle.

Further, some businesses require that vehicles carry a higher level of coverage than what’s available on personal car insurance policies.

If you’ll use your vehicle primarily as a business vehicle, commercial insurance may be required. Further, if you drive for a ride-sharing program, special insurance products are required to ensure you’ll be protected in the event of an accident.

Talk to your broker for more details.

Your Age, Experience, and Driving Record

Riskier drivers pay more for insurance premiums than safer ones.

The determination between a safe and unsafe driver is made, in part, by examining your driving record. Insurance companies look at these records to determine how much of a risk a given driver poses.

Higher-risk drivers include those with fewer years of licensed driving, those with previous speeding convictions and accidents, and those with various other forms of driving infractions.

Your age, and your experience (that is, the number of years you’ve been a licensed driver for) are also considered. Gender and marital status play into the calculation as well, since statistics support an increased likelihood of accidents for males, and un-married individuals.

Note that it is illegal to set insurance premiums based on factors like religion or race.

Finally, your insurance company also considers how many drivers will be driving your vehicle, as well as the records of those drivers.

Your Locale

Your car insurance policy premiums are also affected by where you live.

Since insurance companies typically identify large urban areas as higher-risk for accidents, theft or vandalism, insurance premiums are usually higher for drivers living in these areas.

Your Selected Coverage and Deductible

Most locales require drivers to carry some minimum form of car insurance, and these minimum requirements vary from place to place. From the bare-minimum level of insurance required, drivers may choose to add other forms of coverage against various setbacks, based on their needs, lifestyle, and budget.

Carrying more insurance means you’re more protected, but also, that your insurance premiums will likely be higher.

The deductible is a common means of mitigating the costs of insurance premiums. With a deductible, drivers are responsible for kicking in some portion of the cost of repairing or reconditioning the vehicle, if a car insurance claim is required.

For instance, a car insurance plan with a $500 deductible would see the driver pay the first $500 towards any insurance claim, with the balance being handled by the insurer. In exchange for reducing the payout made by your car insurance company, your monthly premium is lowered.

Your Insurance History

Your car insurance company may also consider your previous car insurance history in setting your premiums. For instance, drivers who have held car insurance continually for many years will typically pay less than a driver who has had one or more significant gaps in their car insurance policy.

If your insurance has ever been cancelled by a past insurer, you’ll likely pay higher premiums, too.

Featured Photo Credit: Shutterstock / Rawpixel.com

Justin Pritchard, an award-winning automotive journalist based in Sudbury, Ontario, is known for his comprehensive automotive reviews and discoveries. As a presenter, photographer, videographer, and technical writer, Justin shares his insights weekly through various Canadian television programs, print, and online publications. In 2023, Justin celebrated a significant milestone, airing the 600th episode of his TV program, AutoPilot. Currently, he contributes to autoTRADER.ca, Sharp Magazine, and MoneySense Magazine. His work as a technical writer, videographer, presenter, and producer has been recognized with numerous awards, including the 2019 AJAC Video Journalism Award and the 2018 AJAC Journalist of the Year. Justin holds a Bachelor of Commerce (Hons) from Laurentian University, which he earned in 2005. His career in automotive journalism began that same year at Auto123.com. Since then, he has written one of the largest collections of used car buyer guides on the internet. His passion for photography, nurtured from a young age, is evident in his work, capturing the scenic beauty of Northern Ontario. Living in a region with a particularly harsh winter climate has made Justin an expert on winter driving, winter tires, and extreme-weather safety. Justin’s significant achievements include: 2019 AJAC Video Journalism Award (Winner) 2019 AJAC Road Safety Journalism Award (Runner-Up) 2019 AJAC Automotive Writing (vehicle review topics) (Winner) 2019 AJAC Automotive Writing (technical topics) (Winner) 2018 AJAC Journalist of the Year You can follow Justin’s work on Instagram @mr2pritch and YouTube @JustinPritchard.

More by Justin Pritchard

Comments

Join the conversation